Is an InvestSMART Portfolio suitable for an SMSF?

You probably started an SMSF because you value your future lifestyle. Whether the primary driver was reducing your fees through the fixed administration costs, increasing your investment power by combining family members or the added flexibility when it comes to investment options your end goal is the same, to have an investment vehicle that will give you a better retirement than the alternative.

Low-cost management

Chances are you started an SMSF because you know the value of a dollar. Instead of paying a percentage of your total nest egg in administration and management costs, you’re able to pay a fixed rate for your administration, saving you thousands. Why should your investment option be any different?

With an InvestSMART PMA, your management fees are capped at $550pa. The power of the cap isn’t apparent at first, but when you consider the average managed fund charges fees of 1.79%pa, you can see how this difference compounds. This means more of your money earning dividends and compounding rather than being deducted in fees.

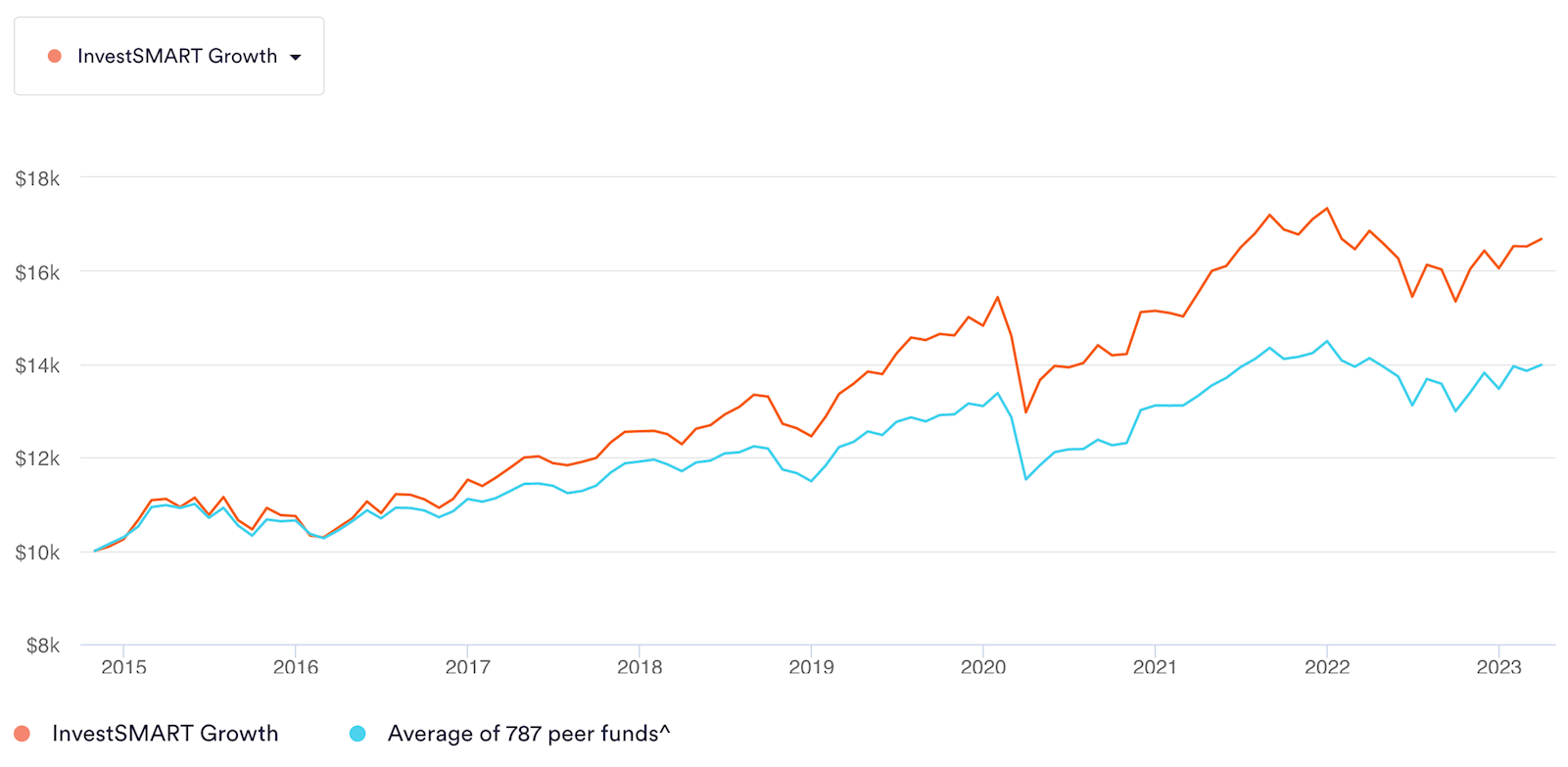

The obvious argument here is, “...surely performance matters. I’m happy to pay a larger fee for a better performing fund”. The problem is that picking one is nearly impossible. Research shows 81% of managed funds underperform the industry standard benchmark over a 10-year period.

Research also shows that a more reliable indicator for performance is funds with below average fees. And that makes sense: over the long-term fund managers revert to the mean (the average market return) when fees are deducted, so you have less money compounding and earning dividends.

Core & Satellite

For many SMSF investors, the InvestSMART PMA portfolios are the core component in their SMSF investment strategy.

SMSFs provide their owners with the benefit of flexibility of investment options allowing them to invest in residential or commercial property, direct shares, managed funds and even collectables. Having confidence in your core strategy is vital.

The InvestSMART PMA portfolios use a range of exchange traded funds to give investors great diversification. With the comfort of knowing this core is in professional hands, investors can branch off in the pursuit of returns and diversification into direct property, private equity or even rare wine.

Convenience & saving time

I hold a few direct shares and ETFs, and it feels like not a day goes by without another piece of mail in the letter box. I end up not opening any of it and always miss my distribution and tax statements. The amount of paper wasted by the share market system is staggering.

You created an SMSF with the idea of a better retirement in mind, not to spend hours going through holding statements, distribution statements, exit statements, periodic statements and tax statements. A major benefit of a PMA is that InvestSMART becomes your letter box.

Your portfolio is viewed and totally managed online. The investments are selected by our team of analysts saving you countless hours delving into the detail of which ETF will give you better exposure to something as boring as global corporate bonds.

Finally, despite being a digital business, we’re run by real people who are here to help you either via email, the on-site chat in the bottom right-hand corner of this page or over the phone. Capped fees doesn't mean capped service, they just mean more time to enjoy your retirement and more of your money earning dividends.

Click here for more information on the InvestSMART Professionally Managed Accounts. If you have questions you can reach the team via the chat in the bottom right of the screen, via email at invest@investsmart.com.au or phone 1300 880 160.